Small businesses frequently find it difficult to select a Merchant Service Provider because of their size. It’s more expensive for smaller businesses to process transactions because they have a lower sales volume.

But don’t be discouraged if you’re a small business paying high transaction fees. There are ways to find the best Independent Sales Organizations (ISOs) for any size business.

Here are some steps to help small business owners find an ISO that fits their business needs:

- Read previous review. Researching the ISO can help give you a sense of how they perform. Read the good and the bad reviews, if notably more people are satisfied with the provider and their service, it is possible you will be too.

- Don’t settle for the cheapest option. Often small business owners settle for the cheapest ISOs in hopes of saving money. Don’t let price be the determinant factor of your decision, consider more pricier options that can still fit your budget.

- Be clear about your needs and wants. Before business owners can find the ideal ISO, they must first understand what it is they need. What are you looking to get from an ISO? Are they going to help you grow your business? The better you understand these questions, the better ISO you will find.

- Look for ISOs who have 24/7 customer service. Small business owners may encounter problems processing payments or have questions on the service. It is important to find an ISO who is available to answer any questions at any time.

- Values relationship building. Look for ISOs who are willing to develop a healthy relationship with you. If they know the importance of positive relationship building, they will be more likely to maintain a healthy relationship with you and help you reach your goals.

What is the purpose of ISOs

An ISO also referred to as Member Service Providers, MSPs, is an organization or an individual that is associated with a bank to provide merchant account services. ISOs are not a Visa or MasterCard member bank.

These organizations work as an agent to connect companies with a processor to support and provide merchant payment services. ISOs can range in size, from small organizations to large corporations. Once your company has been paired with a processor, ISOs provide sales representatives to assist with issues that may arise from the merchant payment services.

ISOs can also allow small businesses to keep track of all their transactions, and help them when their equipment break-downs. Unfortunately, customers can have trouble processing payments at any given time. As a business owner, you know how frustrating it is to lose a sale because the payment wouldn’t go through. ISOs can help in these moments.

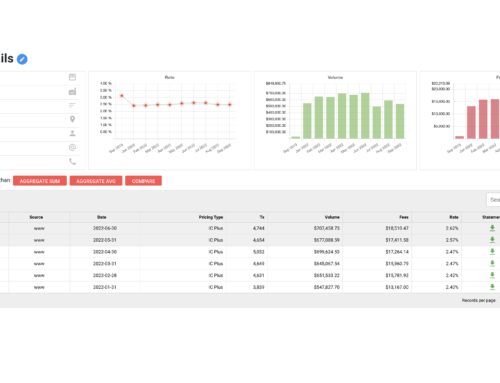

Fee Navigator works to connect business owners with ISOs that can help grow the business. With the use of artificial data and technology tools, Fee Navigator analyzes statements for your business and can help you find an ISO. If you are interested in learning more about Fee Navigator, click here.