We often get asked about the accuracy of Fee Navigator relative to other ways of analyzing merchant statements, in particular methods using manual data entry. So we thought we’d share our thoughts.

Well, let’s just start out by talking about the reasons you absolutely would not want to have a human being analyzing merchant statements by hand.

One, it takes a lot of time and effort, it’s error-prone and it’s usually expensive to hire and train someone qualified to do the work. And two, without double entry data checking, manual data entry error rates are as high as 4%, meaning that in 10,000 data points as many as 400 could be wrong. Is manual entry or automatic data extraction more reliable? – Reveal (opin.com)

In the case of spreadsheets, a key study found that the likelihood of a spreadsheet containing errors sits in the range of 18%-40%.(Cost, and likelihood, of inaccuracy in manual data handling | XCD (peoplexcd.com). Hence, manual data entry processes that rely on spreadsheets as an in-between from the statement to the final result may be close to 50% incorrect.

That being said, merchant statements and payments deals can be pretty complex, so it’s understandable that the main benefit of having a human involved would be to spot and quickly take care of situations where a pure technology solution like Fee Navigator may not work in an automated fashion.

However, Fee Navigator is special because in addition to the engine that does the instant, automated work, it includes a specialized studio to accelerate the review and entry of any missing data.

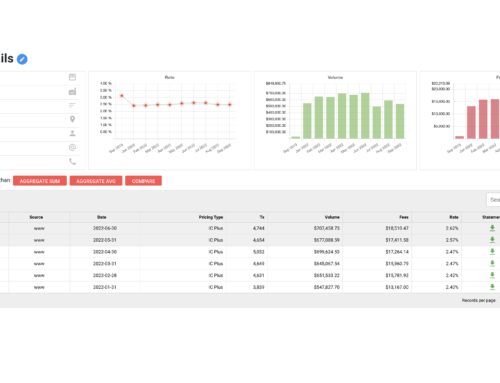

Now let’s consider what happens when Fee Navigator processes a statement.

First off, it’s super fast, as it does in seconds what often gets spent in hours by human analysts. The full cost of analysis also scales down rapidly with volume because a single employee can analyze hundreds or thousands of statements with only a small adjustment in the licensing cost.

When it comes to results, because it’s an automated process, Fee Navigator is 100% accurate given quality inputs. Unlike a human that makes mistakes when they get tired, Fee Navigator will always produce the same results given the same accurate input. In the case of merchant statement analysis, the inputs can be of low quality due to poor scans or original file conditions. It’s possible in this case a human being would have more flexibility to work around scan issues. That’s why Fee Navigator highlights anything it can’t read and provides a Studio to quickly make adjustments or manually correct only the data that couldn’t be properly read.

In fact, by employing our technology, anyone with knowledge of merchant statements can launch their own full-service statement analysis and proposals offering for the industry. We offer our expertise on-demand, but anyone can offer it as their standard offering, because they only have to focus on about 25% of statements that are truly in bad shape.

So, if you’re doing a lot of volume analyzing merchant statements and are not using Fee Navigator, you’re most likely spending too much time and money, and risking errors that could significantly impact your margins or chances of closing sales.

If you’re manually analyzing statements or are outsourcing this job, remember that human analysis does not equal accurate results. And especially with outsourcing, you cannot control the human sourcing, training, management, and scaling processes of your partner any more than they can, so you will never have a clear handle of your true accuracy. Whereas with robot systems like Fee Navigator you can; it may not be 100%, but as technology evolves and scanned documents get replaced with native PDFs – a trend that continues, you will get close to it.

Ready to learn more about Fee Navigator?

Schedule a demo or sign up for a free trial to get started.