Have you ever opened up your monthly merchant statement and actually read it all the way through? We didn’t think so! As a small business owner, time is precious, and the last thing you want to do after a long day is read through a long list of transactions. However, you might miss out on critical details that help boost business and plan more effectively. Even if you’re short on time, there are five numbers you should keep up with every month to track your spending and avoid overcharges.

1. Total Amount Submitted

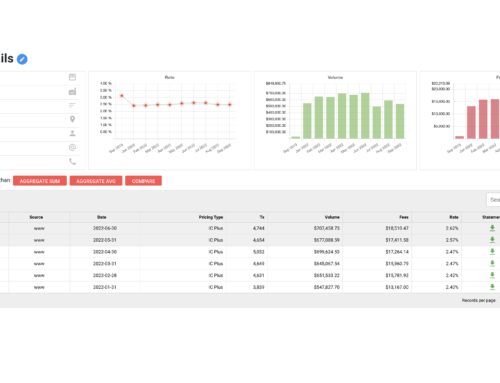

Perhaps the most telling part of your merchant statement is the total amount submitted. This amount includes the total dollar amount of payment card transactions funded to your bank account. This number provides a detailed look at how much money you’re bringing in and where it’s coming from, both of which are crucial to planning business growth.

2. Total Fees

Before taking off and spending your revenue, you have to make sure to cover fees. The fees you’ll find on your merchant statement are fees that are passed to you from the issuing banks, card brands (Visa, MasterCard, Discover, American Express), and the processor who authorizes and settles your credit cards transactions. It’s good practice to keep up with these fees to check for overcharges.

3. Effective Rate

Payment processors, credit card companies, and banks charge fees to process each transaction. Your effective rate is the average percentage you pay for all of your credit card transactions. Keeping an eye on this fee could help you discover whether you’re paying a fair amount for processing fees. On average, companies can expect about 3-4%.

4. PCI Non-Compliance Fee

PCI-DSS requirements are there to ensure that merchants are handling customer payments securely. Your processor can tack on a PCI non-compliance fee if you do not complete the PCI DSS Self-Assessment Questionnaire and provide evidence that your business passed a vulnerability scan with a PCI Approved Scanning Vendor. PCI CSS regulations are split into four merchant levels based on the credit card payments volume your business processes each year (Level 1, Level 2, Level 3, and Level 4).

5. Chargebacks

Customers have the right to dispute charges if they did not make them. These disputes will show up on your statement as chargebacks, which you should monitor frequently. Note any suspicious activity so that you can get to the bottom of issues before they become too serious.