Artificial intelligence (AI) is making a splash industry-wide, helping businesses gain efficiency and maximize production. In financial services, the incorporation of AI-powered fintech is on the rise, expected to account for $110 billion of organizational financial investments by 2024. These high-tech tools offer solutions for issues surrounding merchant services, taking proficiency to all new heights.

Amping Up Fraud Defenses

Card-not-present fraud is said to cost retailers $130 billion over the next five years. It’s not a simple issue to tackle, especially with more transactions happening online than ever before. To amp up fraud defenses, organizations are turning to AI and machine learning. Advanced algorithms process loads of data more efficiently than any human can, quickly spotting out-of-the-ordinary activity. With immediate and pinpoint detection, payment processing becomes less of a worry industry-wide, and card-not-present fraud gets stopped in its tracks.

Evolving Customer-Merchant Experience

Giving consumers an in-store experience out-of-store is a challenge. There are not enough hours in the day, and some companies just don’t have the budget for around-the-clock customer care. Infusing AI into merchant services, industries can sit back while customers enjoy a seamless experience and, if necessary, human-like assistance with the help of chatbots. Thanks to innovations in natural language processing (NLP), consumers can feel a personal touch without the need for organizations to increase staff.

Adaptable Underwriting

Underwriting merchants is a detailed process with analysis and evaluations of a business’s potential to process payments. Because there are risks involved for both merchants and companies, there’s a lot of paperwork involved that holds up the ability to jump in and start making transactions. Again, AI solutions come to the rescue, providing adaptable analysis of merchants in real-time. With a better understanding of chargeback incidences and fraudulent claims, companies will have safer transaction environments, free of fraudulence.

Digital Evolution of Merchant Services

Payment processing works thanks to data. Large amounts of potentially valuable data are passed back and forth between consumers, banks, and companies, which organizations can use to their advantage if they know-how. With the right tools, the automatic analysis of data looks for trends, changes, and patterns. Digitally driven solutions for business increase visibility across all ends and help businesses make better and more effective decisions to increase productivity and promote growth.

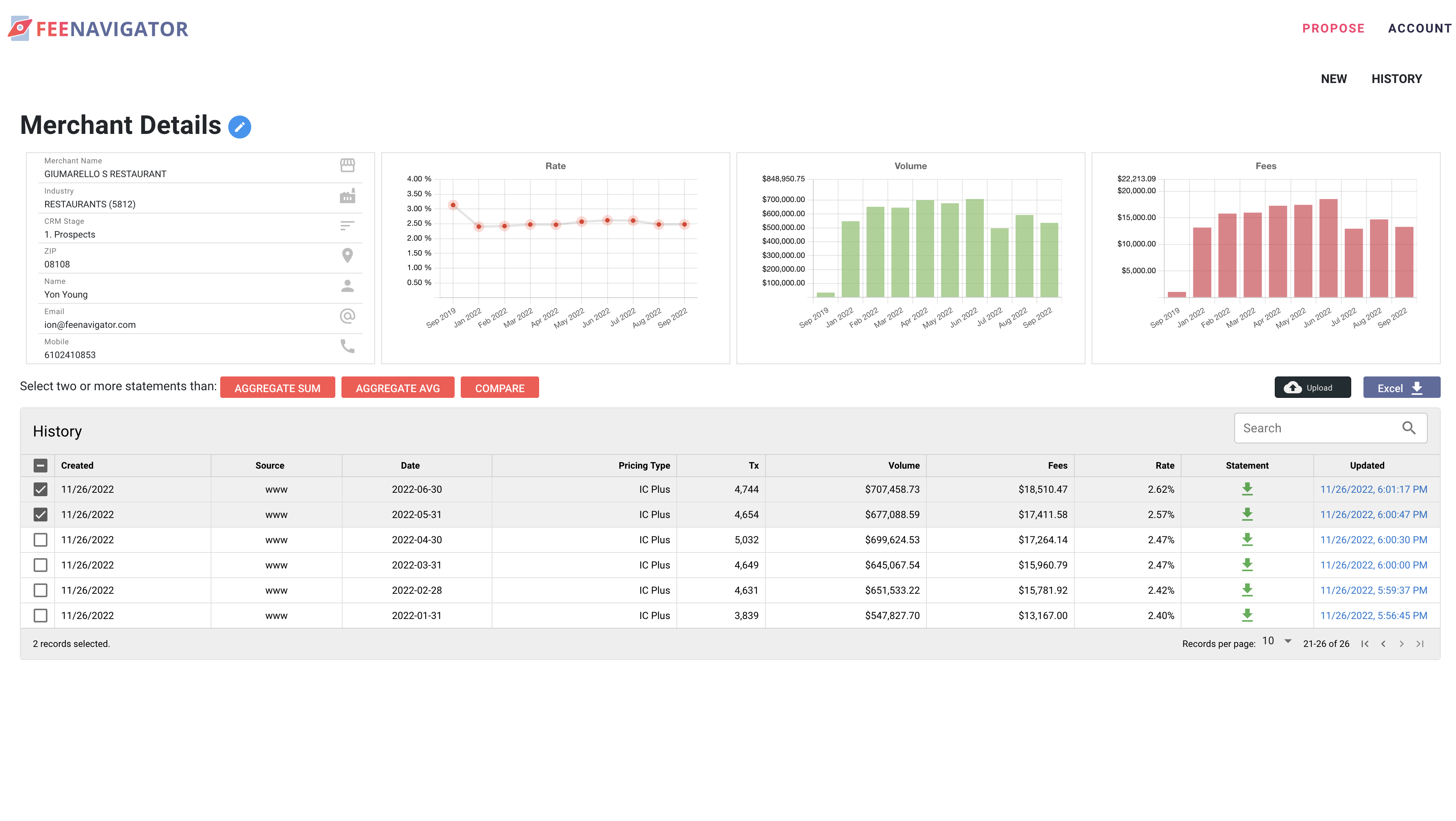

Advanced Tech that’s Human Friendly

Incorporating AI-powered automated merchant services into your business doesn’t have to cause headaches. Fee Navigator eliminates the need to enter data manually with a drag and drop option for instant analysis. With analysis, estimates, commissions, and profits all in one place, financial planning, and foresight become simple. The days of banking on premonitions are over. Now, companies can make insightful decisions and invest their money where it matters most.