Details each requirement you need when applying for a merchant account

What you need to know about opening a merchant account

Business owners have probably told you that a merchant account is crucial to taking your business to the next level. However, few business owners will take the time to explain what a merchant account is. So before starting the application process, you should know exactly what a merchant account is and does.

What is a merchant account? What do merchant accounts do?

In simple terms without complicated industry jargon, a merchant account is a bank account issued by a merchant bank that allows your business to accept credit cards. A merchant account allows immediate access to the proceeds from credit card payments accepted, minus the fees from the merchant bank, before your customers pays their credit card bill.

After the merchant bank sends the request to the customer’s creditor, the customer and creditor have a standard 6 months to dispute the request. If the dispute is valid, your business is responsible to reimburse the customer. If your business has gone out of business and can’t complete the reimbursement, then the liability falls to the merchant bank.

Because of this possible liability, merchant banks have strict requirements for the application to open a merchant account.

Requirements to start the application process

In order to be able to apply for a merchant bank account, the business needs:

- To be legally registered within the U.S. Your business must be legally incorporated in the US. If you are a sole proprietorship, you would need to submit a “Doing Business As” (DBA) name.

- An address in the U.S. Your business needs to have a physical office that would allow merchant banks to verify. Also, home offices are acceptable.

- A U.S. bank account A merchant bank will send funds from the credit card proceeds to US bank accounts, only.

Qualifications to be approved for a merchant account

After fulfilling the requirements to apply, the business owners need to submit materials to merchant bank. The merchant bank will then determine whether to approve or decline a merchant account for your business with the following materials:

- Application form The application form requires information on both you and your business. Information asked about will include social security number, office address, bank account info, email address, phone number and so on.

- Articles of Incorporation Only sole proprietorships don’t need to submit the articles of incorporation.

- Business license. If you have either a federal or state business license, you will need to submit it.

- Business financial statements. Typically, your business needs to submit the past two year financial statements. However, if your business was recently formed or a sole proprietorship, your business will be asked to submit personal financial statements instead of business financial statements.

- Business and personal credit history. Credit history of your business and personal accounts will allow merchant banks determine whether your business is low or high risk.

- Business profile and marketing materials. Merchant needs to check if your products or service is on the restricted or banned merchant list.

- Processing statements. If your business currently accepts credit cards, you would be asked to submit 3 past merchant statements.

- Voided check. A business owner needs to submit a voided check from the bank account the money from the credit card payments would be deposited in. For sole proprietorships, the “Doing Business As” (DBA) name needs to be preprinted on the voided check.

- Compliance with the Payment Card Industry (PCI) Data Security Standards (DSS). A business following the PCI DSS ensures that the customer’s account information is reasonably protected.

- Site inspection. A site inspection will be conducted at the office and warehouse of your business. If your business has multiple offices, only one office inspection will be enough.

- Other requirements. If there is a third party involved in fulfilling the order, then information about the third party will be required. Also, there will be an inspection of the third party’s office.

All of these materials are used by the merchant bank to determine how risky your business is. After they determined the level of risk, merchant banks will notify your business if it has been approved or declined for a merchant account.

I got approved by multiple merchant banks…Which one do I choose?

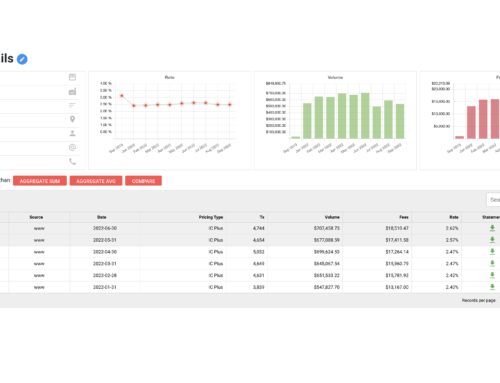

After signing up with a merchant bank, you will start receiving merchant statements. The merchant statement analysis can become overwhelming, because of the complicated and confusing paperwork. With AI-powered statement analysis and their flexible pricing, Fee Navigator will help you understand and monitor your fees.