What should a business do if it is labeled a high-risk merchant? This blog gives merchants alternatives when they learn their business will have to pay more to accept payments.

But before we begin, you must first understand what it means to be labeled a high risk merchant. Businesses, whether online or brick and mortar, use Merchant Services to accept multiple payments from customers. A company that is labeled a “high risk merchant” poses a higher financial risk than those who are considered ordinary accounts. As a result, these businesses end up paying more to process payments, like credit cards.

A business can be identified as a high risk merchant for many different reasons, including personal credit history, business financial information and possessing a high risk of chargebacks.

Steps to take when you are labeled a high risk merchant

-

- Be honest. When looking for a merchant service provider, be honest about your business. This will help you find a service provider that will satisfy your needs not only in the short-term, but also in the long-run.

- Supply the service provider with your previous merchant services. By doing this, the service provider will be able to match you with a program that adequately suits your needs.

- New businesses should renegotiate better terms once the business is more stable.

- Control chargebacks. Instituting procedures to check official customers identification, credit card expirations, having employees do signature checks, etc. can reduce chargebacks.

- Take the time to get to know and satisfy your business’ needs for processing, which include POS systems, mobile acceptance, online shopping cart services and credit card terminals.

How To Determine Whether A High Risk Payment Processing Service is Right For You?

As a high risk merchant, you’ll need to find a high risk payment processing service that adequately fits your business. It’s important that you research various payment processors or merchant services before settling with one option.

When meeting with the different processors, make sure you ask questions about payment processing, such as what services does the processor provide; what tools are available for data security and fraud protection; and what rules will be included in the contract agreement.

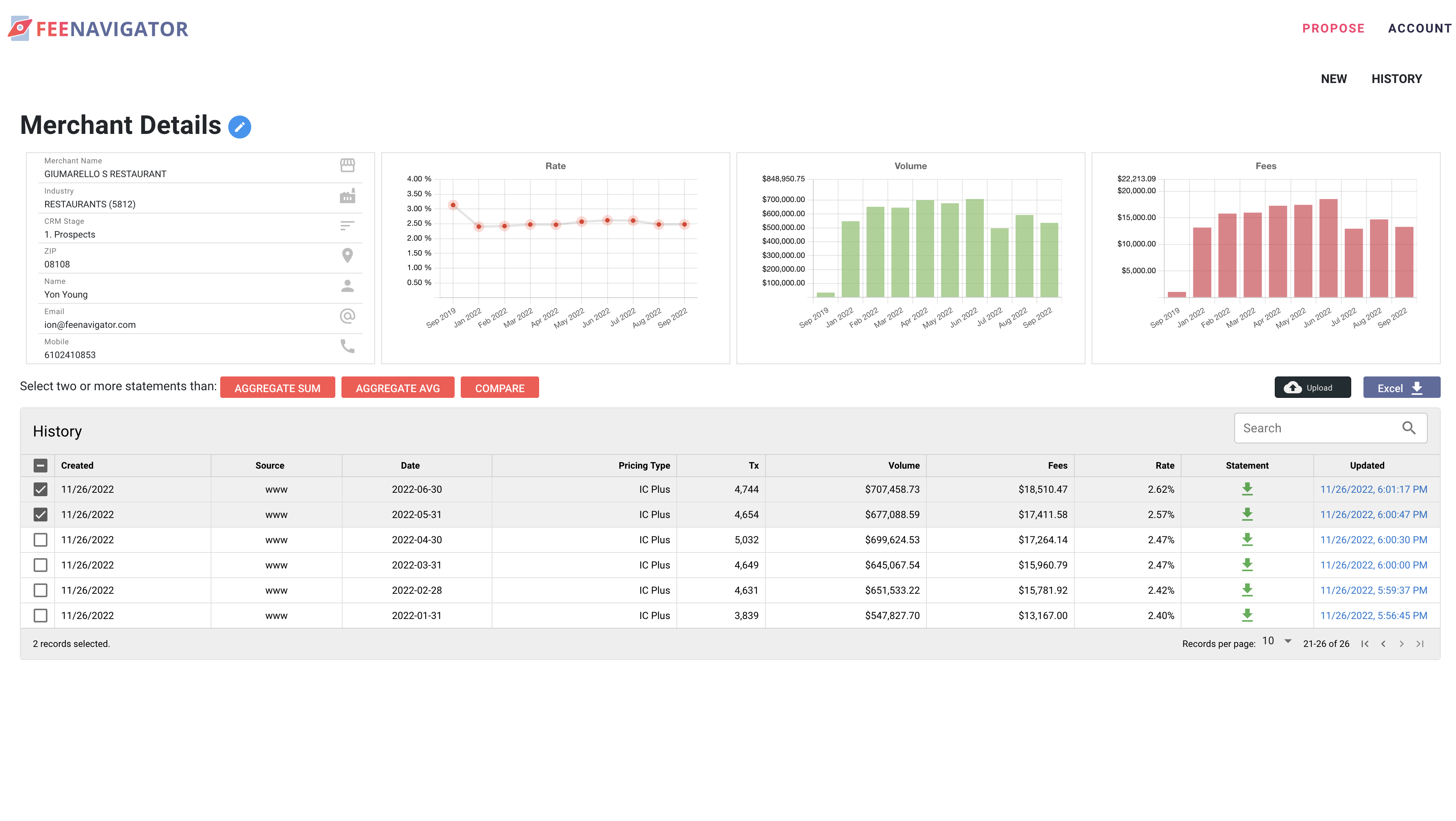

If you need help figuring out which high-risk processor is the right one for you, Fee Navigator can help with an analysis of your statement. Our AI-powered statement analysis will review your statements and identify your fee structure.