If your business accepts credit card payments, odds are you’re paying merchant fees. These fees are essentially what your business pays intermediaries, like processors, who ensure your customers’ digital payments go through. A merchant statement details how much your business owes in merchant fees.

Today, the merchant industry is undergoing major changes that will impact how much businesses pay in merchant fees. The most important of these changes is the automation of statement analysis. Here’s why Fee Navigator predicts statement analyst jobs will likely die out in the coming years.

Computers Are Just… Better

Computers do pretty much everything better than people, and it’s only a matter of time before this technology disrupts the way merchant statements are analyzed. Statement analysts usually just use specific formulas to calculate your merchant fees.

Unfortunately, these formulas can be pretty complicated and the numbers that go into them can be hard to keep track of. Most statement analysts today just base themselves off estimates and get results within a certain margin of error.

On the other hand, computers can keep a full record of every transaction you make and can process the data into those formulas at superhuman rates. This means that computers get you more accurate results faster and, from a profit perspective, it just makes more sense to replace people with computers.

Computers Become More Profitable As You Grow

Processors are essentially responsible for getting the bank’s authorization for the transaction and then transferring the money over. Think of them as the machines that scan your card. The more established your business is, the more processors it’ll be working with.

If you think it’s hard to be efficient with one processor, wait until you get five statements analyzed. This increased number of statements will increase your margin of error.

Computers can compile data in a matter of seconds while it would take hours for humans to do it. This means computers don’t need to “save time by estimating”, another reason why computers are more likely to get you more accurate results faster. Also, with so many processors (or processing companies) to choose from, it’s hard to be sure whether or not you’re getting the best deal you can.

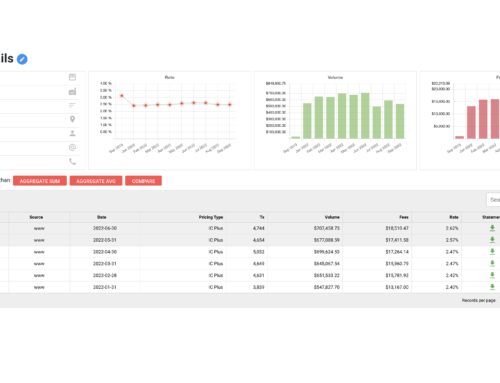

Digital platforms like Fee Navigator are specifically geared towards making sense of merchant statements. Again, technology is more efficient in terms of time and cost than humans so there’s no reason not to use it.

Similar Trends in the Rest of the Merchant Services Industry

Statement analysis is not the only part of this industry that’s changing. According to Supermoney’s 2019 Consumer Credit Card Industry Study, debit cards are the most popular method of payment. The study also states that the credit card market is growing faster than the overall economy.

These statistics imply that there’s going to be higher demand for processors and related software in the near future. This is because more transactions open up space for more processors. And with more processors comes more pricing options, making it more difficult to select a processor. This is when software becomes even more essential. It’s safe to say the industry will become increasingly automated as it evolves.

Why Should You Care?

Whether you’re a merchant or a bank, you can’t overlook how much the industry is growing. About 160 million people in the US hold at least one credit card and card users buy about 18 percent more than their paper money counterparts according to Brandon Gaille.

If you want to be ahead of the curve when it comes to digital transactions, Fee Navigator can help you understand and keep an eye on your merchant fees. Their AI-powered statement analysis and flexible pricing can provide guidance to make sure your business works as efficiently as possible.