It’s important for high-risk merchants to understand processing rates before they commit or sign up for any services. Here’s a closer look to help you better understand processing rates and reasonable fees associated with high-risk processors.

What’s your Level of Risk?

The most important factor for high-risk merchants is their “level of high-risk.” Even within the high-risk category, businesses can be classified as more or less risky.

For example, vape and e-cigarette businesses tend to be classified as less risky than gambling-based businesses. On the lower end of risk, rates can be between 3 and 3.5 percent of your transaction. On the higher end, you can see rates of up to 10 percent, or even more in some rare cases.

Keep in mind merchant rates are subject to multiple factors. Generally speaking, no two businesses will get the same rate – even if they have the same risk level.

Is my business paying too much in merchant fees?

If you’re an established business on the lower end of risk, and you’ve been honest with your application statements, there’s no reason your business should pay more than 5 percent of your transactions to your processors. Merchants that are hard to peg on the risk spectrum should never pay more than 10 percent, unless they’re extremely high-risk.

High-risk merchants that have been turned down by high-risk processors in the past might not have that many options in terms of processors and pricing.

Know What You’re Paying For

Processors won’t just charge you a general fee for credit card transactions. Each transaction is tiered into a pricing system, based on non-qualified, mid-qualified or qualified transactions.

Definitions for Merchant Fee Classifications

Non-Qualified:

A non-qualified transaction refers to any type of payment that’s paid entirely without a credit card, but that’s also not paid in cash. This includes rewards cards or anything that is sold without needing a customer’s billing address.

Mid-Qualified:

A transaction is mid-qualified when it’s only partially paid with a credit card or if the credit card isn’t present for the transaction. If you sell something online or at a discount from a rewards card, you’ll be charged at a mid-qualified rate.

Qualified:

Any transaction that doesn’t fall into either of the previous categories is qualified. This is essentially just a regular credit card transaction.

Most high-risk processors will advertise their qualified rate because it’s their lowest rate. Before signing with a processor, make sure you look at all of their prices.

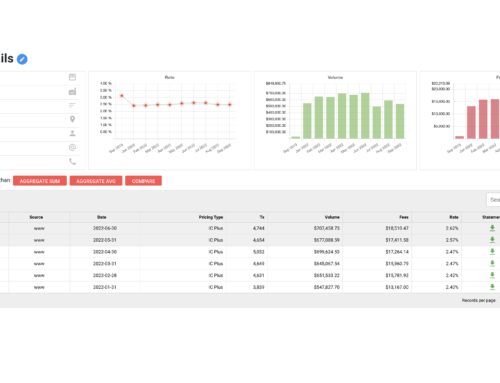

Individual processors can decide for themselves which transactions fall into which tiers. And they can change their minds whenever they want – without telling you. This is why it’s crucial to stay up-to-date with your processors. You don’t want to be surprised at the end of the month when you open your merchant statement.